Edge computing is not only about having technology but also a smart business model.

This statement is particularly true for telcos.

And the telcos know about it. They know that with the new 5G core, they have an opportunity to deploy a more intelligent and service-oriented network edge which can open new business avenues like ultra-low latency use cases (AR/VR, connected cars, IIOT, low latency gaming, etc.)

However, they also know that they need have a proper go-to-market strategy (GTM)

Without a smart edge business model, they may leave the “greenfields” to more active players like the hyperscalers/public cloud players (AWS, Azure, Google Cloud)

Yes, the cloud players are quite active and aggressive in the edge area. Amazon’s “AWS Wavelength“, “Azure Edge Zones” and Google’s “Anthos for Telecom” are just a few examples that show the ambitions of these players.

On the other hand, the telcos/CSPs are not completely disadvantaged either:

They own the network-which is their biggest asset. Therefore, they can use their base stations, pops, and central offices to bring computing resources as closer to the users as they like.

Why this is important?

The edge applications can be “edge-aware” or “edge unaware”. However “edge-aware” applications are becoming more important and popular and they need to communicate with the network and understand network information like latency and location. In short, application owners need to work closely with the telcos in this area.

No doubt, hyperscalers have a stronghold when it comes to the edge applications marketplace.

But in the edge business, they will still need to collaborate with telcos closely.

But how they can work together? Why not a telco introduce a marketplace of its own?

Unfortunately, there is no ONE answer to these questions?

So with this piece of article, I want to write about the different business models telcos may have in relation to hyperscalers in the area of edge business. The different ways in which they can compete as well as cooperate.

Nevertheless, when it comes to the field of Multi-Access Edge computing (MEC), telcos need to play smart with cloud edge to synergize with the hyperscalers.

Let’s explore the different Edge Cloud business and operational models for telcos. This is purely a comparison of operators and hyperscalers for the telco edge. There may be different business models for telcos other than that.

However, I would like to pause the discussion for a moment, and have a quick refresher on the high-level view of the edge stack, as this is important to understand before understanding the business models.

Fair?

Let’s dive in.

What is the Edge stack? Understanding it before understanding edge computing business models for telcos.

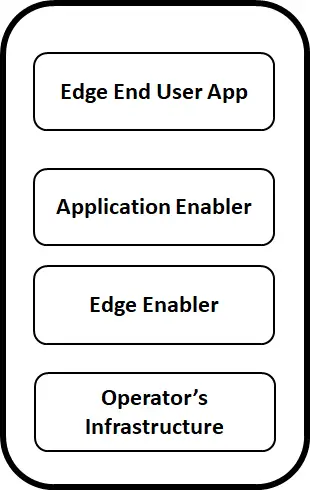

The following figure is adapted from LFedge that shows multiple layers.

Operator’s Infrastructure

This is the “access network” used for Edge services. This can be a fixed network like FTTx or it can be a mobile network used for Telco edge. The edge location can be anywhere like a base station site, one hop away, two hops away or further depending on the latency requirements. Anything related to the operator’s infrastructure is included here like 5G core but in addition, may also include virtual resources ( VMs) so that edge applications can be onboarded.

Edge Enabler

The Edge Enabler software layer sits on top of the operator’s infrastructure. It is the layer closer to the network and as such has the network information like radio quality, location awareness (important for “edge-aware” applications). In the ETSI MEC architecture which I explained here , this is the “MEC platform” that acts as an Edge enabler. Normally such a platform is provided by the telco as Edge enabler interacts with the 5G core network using 3GPP APIs. But a Telco may work on a model to have a third party bring its MEC platform and use only its infrastructure.

Application Enabler

Bringing Edge Enabler is not enough, there needs to be an application enabler too. Application Enabler is like an abstraction layer on top of Edge Enabler.

For example, do you think the application developers for edge apps want to bother about 3GPP interfaces and how they work?

They do not care about it. Application Enablers sits in between Edge Enabler and edge applications Its mission is to provide edge app developers friendly APIs, allowing them to consume and manage specific telco network capabilities without having to know about the underlying telco network!

Edge End-user App

This is self-explanatory ( i.e. end-user edge application)

Edge computing Business Models for telcos

Let’s take into account the different operational models for telcos in the area of edge infrastructure.

Where there may be multiple models for telcos to work and there may other edge service providers besides the hyperscalers, but I am focusing on hyperscalers here to make the demarcation between the two clearer.

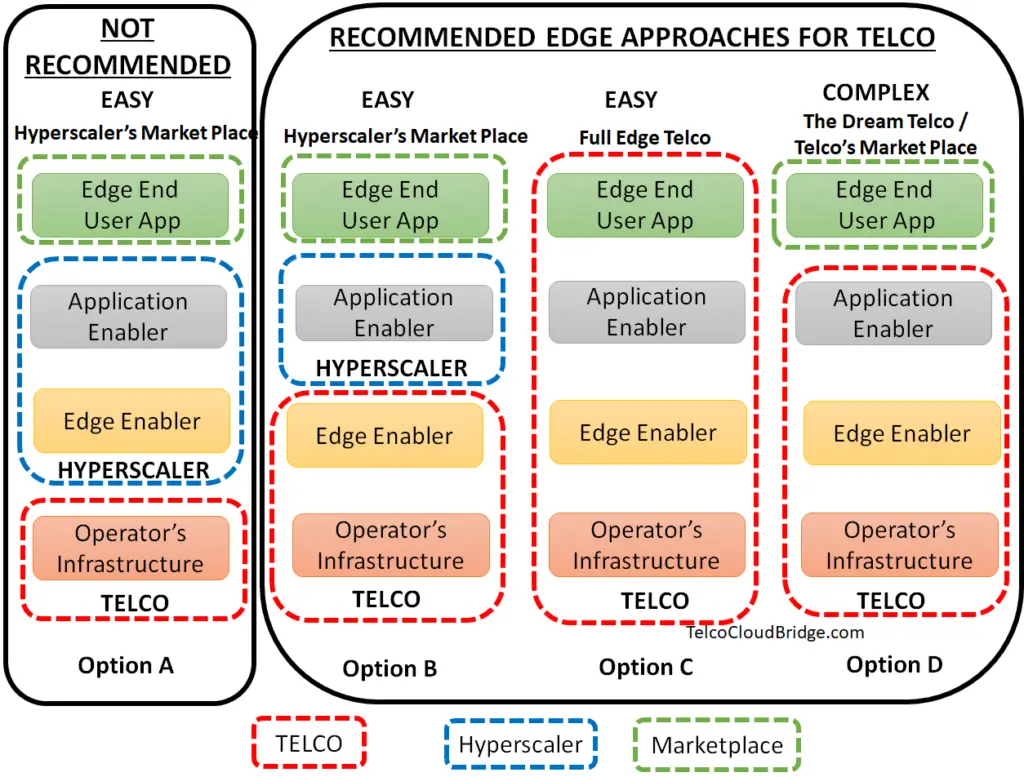

The Commodity Telco-Option A

This can be called the “Commodity Telco” because it is present at the bottom of the business value chain.

The Telco does not have any of its edge services, neither own its MEC platform. It just provides its infrastructure for example 5G core. The hyperscaler brings its Edge Enabler layer (MEC platform) and integrates it directly with the infrastructure. The rest of the stack all belongs to the hyperscaler including the edge marketplace portal.

As the marketplace is facilitated and provided by the hyperscaler through its portal. The app developers have a direct interface with the hyperscalers with no visibility for the Telco.

Most likely the hyperscaler is paying for using the operator’s infrastructure on some basic usage model such as a “pipe model”

We can say that the Telco here is completely “commoditized” and as such not a recommended approach for telcos.

The Edge enabler Telco-Option B

In Option B, the telco introduces its MEC platform as Edge Enabler. While the hyperscaler brings its application enabler platform along with its marketplace.

This can create a win-win situation for the telco. The telco has risen in the value chain above. The ROI for the Telco is higher compared to the commodity model in Option A and can charge a premium service for providing its MEC platform.

In this model, the marketplace is still owned and controlled by the hyperscaler. However, the telco may work out a revenue-sharing model with the hyperscaler instead of offering flat fees or a basic consumption model.

The Full Edge Telco-Option C

This is the easiest to implement option for the Telco

In this Option, the Telco owns and operates the complete stack.

The telco can provide a vertically integrated service to its customers. An example service is a private edge service for its enterprise customers such as industrial IoT. A variation would be offering services up to the application enabler layer and let the enterprise customers use their applications.

The telco is free to price and charge its customers, the way it likes.

The Dream Telco-Option D

This is the Dream Telco because every telco would like to be in this place although most complex to implement.

As compared to Option C, the telco now offers its marketplace so that developers can develop the applications and sell them on the marketplace. The telco has full control of the marketplace and can charge a premium for its services. The revenue potentials of the Telco are much higher as the Telco is working now in the “applications” space and at the top of the value chain.

Recommended Approach for Telcos.

Unfortunately, there is no one best option considering the current state of telcos.

Option A is NOT recommended

The Commodity Telco such as Option A is NOT a recommended approach. A passive telco with no edge strategy risks being approached by a hyperscaler offering a commodity model. The telco has no visibility to applications, not getting any premium revenue here.

Options B, C, D are recommended approaches

In my view, the recommended approach for telco is a mix of Option B, C, and D. ( that is either choosing one of them or combining them)

If a telco would choose, of course, it would like to be the Dream Telco.

However, the Dream Telco needs to run a full stack including its marketplace. To be successful, it needs to have DevOps of its own and an ecosystem of developers, and a very aggressive go-to-market GTM strategy. As it stands, the majority of Telcos are at the early stages in all these three.

However, there are still a handful of Telcos that can fit in this category but not the majority.

Conclusion: Starting with Option B and C together is the best

For the considerable majority, starting with options B or C in parallel would be practical and easier to implement. They need to join hands with the hyperscalers and in parallel have a full edge stack for its private customers. This would give them quick access to the market places which the hyperscalers already own.

Come to think of it, collaborating with hyperscalers gives easy to access considering the maturity of the ecosystem they provide. Any developer today would like to integrate with Azure, Amazon, or google cloud. To reach that level will take many years for a lot of telcos.

To get the benefit of the edge today, that seems to be the practical option to start collaborating with the hyperscalers.

However, in the long run, the telcos can aim for Option D to be completely independent and run its edge network on their terms. For this to happen, the telco needs to have a strategic plan of digital transformation at all layers: technology, organization as well as business layers.

So do you agree with me or not?

So what is your tack on telcos vs hyperscalers in the telco edge area?

Can telcos compete with the AWS wavelength and Azure edge zone, if they remain in the status quo?

What strengths do cloud providers have that CSPs do not have?

leave a comment below and tell me what do you think?

Very good insight Faisal. Absolutely new thing for me at least.

Hyperscalers & Telcos have their own strength & weak areas but in this space, I believe hyper-scalers are having an extra edge over the Telcos.

The only thing that they lack is the network (infrastructure) so, they would be vouching for Option-A.

Telcos, on the other hand, lack the rest of the stack (Edge enabler, Application enabler & App) but today it is not difficult to build the rest of the stack because of the high availability of open-source software & growing DevOps community & developers.

I think it is only the willingness of the Telcos to transform themselves as SaaS providers instead of a traditional network player, which will make them a leader in this space. (As you mentioned quick GTM).

At present I see 2 players in APAC region going in this direction – Rakuten (Japan) & Jio (India)

Thanks Asad. I have issues with the notifications, i could not see your comment earlier. The point is building the “stack” and the GTM…… As you said telcos may build the former but I doubt their capabilities on the later one…

Faisal,

Very interesting business model canvas you have created for Telco’s. Edge computing success will live or die based on how the “last mile” is leveraged.

You are only as good as the weakest link in your value chain, and this is where the Hyperscalers absolutely need the infrastructure Telco’s provide.

Work that MEF is doing with our Edge Computing project and our LSO Sonata and Cantata work stream can help guide the API interoperability needed by Telco’s and Hyperscalers to bring the two worlds together as you depict in Option D.

Great contribution to the discussion.

@michael, thanks for sharing your ideas…I will have a look at the Edge computing project of MEF.